Removing Payment Friction with the Payments Network

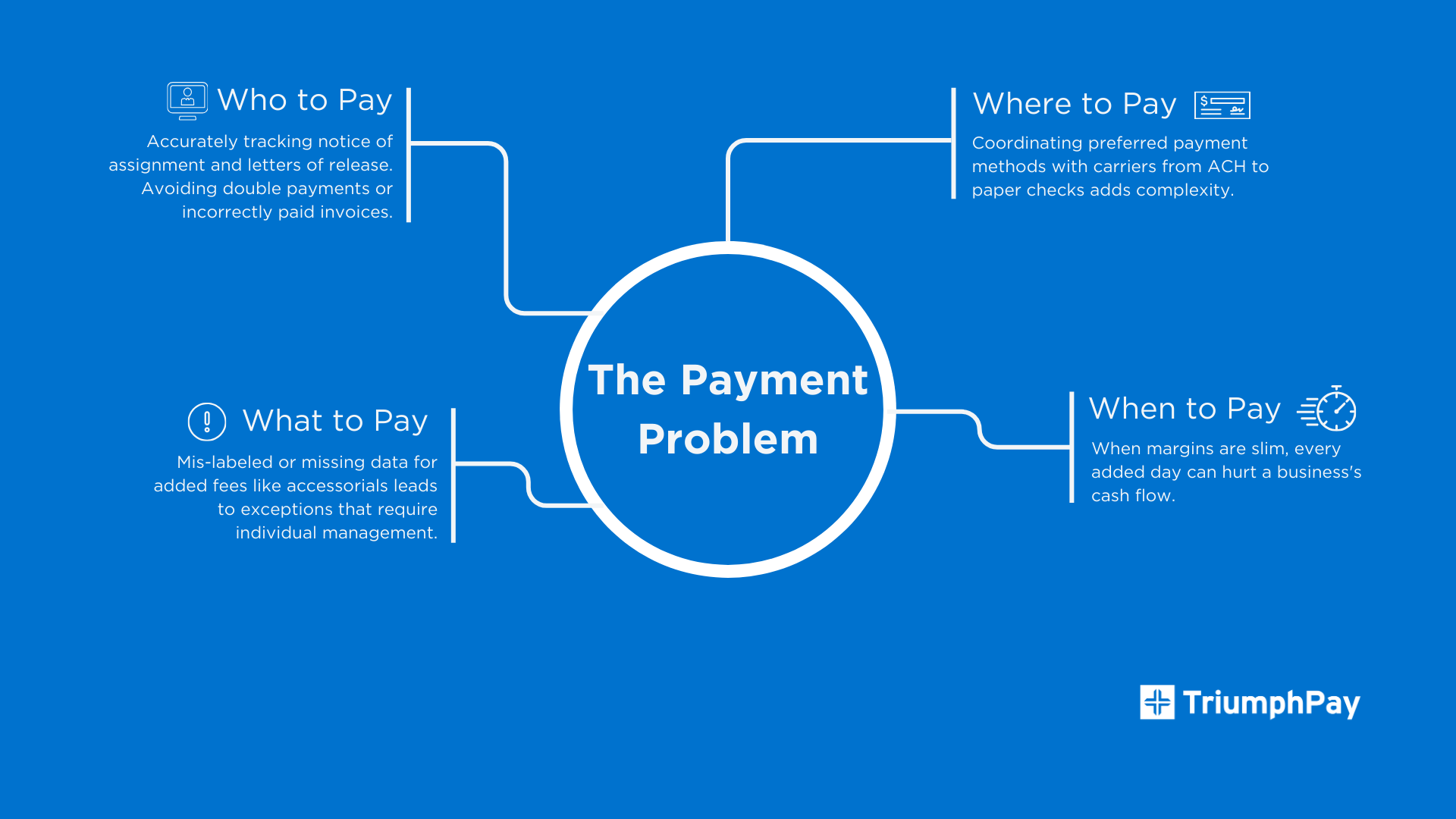

The transportation industry relies heavily on efficient payment processes. With numerous AR and AP processing tasks occurring between businesses daily, managing payments can quickly become a daunting task. Errors and exceptions impact cash flow management and create very real implications for businesses both large and small. All parties in the payment process –brokers, carriers, shippers, and factors – encounter difficulties in the payment process caused by the sheer volume of parties involved, each with their own variable processes. For payors, those primarily manifest as issues regarding who to pay, what to pay, where to pay, and when to pay. By adopting a streamlined payment system, businesses can reduce this friction in back-office tasks, improve cash flow, and more quickly grow and scale.

Understanding the Payment Problem

Freight billing and payments has been prone to error in the past as it relied so heavily on manual processes including the careful submission, tracking, and processing of paper documents in the form of pdfs—many with handwritten notes—and a tangled web of phone calls and emails. However, payment processing between brokers, carriers, factors and shippers remains complex even in an era of increasing technology adoption. Freight payment problems frequently arise in one of four areas:

- Who to Pay:

When multiple parties are involved in transactions, even simple tasks like ensuring each party is paid correctly can become complex. For shippers and brokers, this complexity may lead to difficulties in accurately tracking notices of assignment and letters of release for each factored carrier invoice. This is important to avoid accidental double payments or incorrect payments. It’s worth noting that brokers may not make efforts to recoup funds due to the challenges involved in tracking these notices and letters for factored invoices.

- What to Pay:

Thanks to TMS integrations, more invoices can now reach ‘ready to bill, ready to pay’ status more quickly than ever before. The timely and structured data provided is essential for the transportation industry. The Payments Network minimizes risk and cost by utilizing structured data between parties, swiftly identify issues for payors to address at an early stage. Transportation payments often include various charges and fees such as accessorial fees or fuel surcharges. Mis-labeled or missing data for these components can result in exceptions that require individually managed.

- Where to Pay:

Even when the carrier isn’t using a factor, the industry uses multiple channels and methods for payments including paper checks and ACH payments according to each carrier’s preference. Keeping up with carrier remittance updates is challenging, particularly when you consider the prevalence of fraud. No shipper or brokerage wants to later learn that payments were misdirected due to freight fraud, so it’s important to have safeguards in place such as working with a secure payment partner who makes sure payments are sent to the correct party.

- When to Pay:

Payment terms may cause more strain on relationships between brokers, shippers, and carriers than any other aspect of the financial transaction. When margins are slim, every added day of DSO can hurt a business’s cash flow, disrupt the carrier’s ability to take the next load, force the carrier to delay necessary equipment maintenance expenses, or cause a carrier to slow-pay its drivers. Payment terms can have an impact on brokers as well, with many brokers offering QuickPay options to preferred carrier partners while managing their own cash flow issues on the back end.

Enter The TriumphPay Payments Network

TriumphPay is a dedicated payment platform designed to address these challenges in the transportation industry. With more than $25 billion in payments flowing through the TriumphPay Payments Network every year, we’ve been able to continually evolve our offering to best meet the needs of every side of the industry. Features like real-time settlements, POD Detection, and automated invoice processing add speed to the payments process, while integrations with major Transportation Management Systems (TMS) such as McLeod, MercuryGate, Turvo, Mastery, and Revenova mean less human handling of data, eliminating the need to rekey information and potentially introduce errors. In one recent example, top 5 broker RXO reduced days to bill by 25% and improved billing accuracy. The TriumphPay Payments Network offers ease of use and speed for smaller teams as well. Glen Raven Logistics saw a 75% reduction in human hours per week through automation of the presentment, verification, and payment of invoices, while the implementation of QuickPay improved carrier access to cash. The platform benefits brokers, carriers, and shippers alike by simplifying payment processes and enhancing operational efficiency.

Streamlining Back Office Tasks and Improving Cash Flow

One way the TriumphPay Payments Network allows businesses to operate more smoothly is by reducing the administrative burden associated with payment processing. By automating invoice processing and enabling real-time settlements, the platform helps logistics providers improve their cash flow, allowing them to stay in operation and focus on growth rather than administrative tasks. For brokers, reducing that administrative burden can strengthen business relationships by offering better experiences to shippers and carriers and enabling the business to manage by exception, focusing attention on the issues that matter.

Ensuring Security and Reliability

Security is paramount in all payment platforms and an increase in freight fraud has made this especially true in the transportation industry. In a recent survey, 85% of brokers and carriers were affected by double brokering, leading to financial losses ranging from $50,000 to over $500,000. The TriumphPay Payments Network creates a more secure hub for the presentment, verification, and payment of invoices. By connecting all parties in a structured, verified manner, TriumphPay ensures all payments over the TriumphPay Payments Network are to legitimate parties, performing checks along the way. TriumphPay does all this using advanced encryption technology to safeguard data, ensuring that all transactions are secure. The platform’s reliability and trustworthiness make it a preferred choice for businesses looking to streamline their payment processes.

TriumphPay simplifies the process of determining who to pay when carriers select their own payment destination, and its wallet verification ensures that the correct party receives payment. Additionally, TriumphPay’s partnership with Highway, particularly with our Load Limit product, provides unparalleled visibility into double brokering activity and reduces broker exposure to risk.

A Reduced Friction Future for Freight Payments

By addressing the complexities of who to pay, what to pay, where to pay, and when to pay, the TriumphPay Payments Network helps brokers, carriers, and shippers improve their operational efficiency and financial well-being. Adopting TriumphPay reduces administrative burdens and improves cash flow. For more insights into the challenges of payment processes in the transportation industry and how TriumphPay addresses them, listen to The Payment Problem with Haley Evans on the Logistics of Logistics Podcast.